Paystubs are vital documents for employees, contractors, and freelancers, providing a detailed breakdown of earnings, deductions, and taxes. With the rise of online tools offering free paystub generation, many individuals now have the convenience of quickly creating these documents. However, this convenience comes with its own set of challenges. Errors in free paystubs can lead to confusion, delayed payments, or even legal complications.

In this guide, we’ll explore common errors in paystubs generated for free and provide actionable steps on how to fix them, ensuring the document is accurate and compliant.

1. Incorrect Personal Information

Problem:

One of the most common issues with free paystubs is incorrect or incomplete personal information, such as the employee’s name, address, and Social Security number (SSN). This could happen due to typing errors or the auto-fill function misinterpreting details.

How to Fix It:

- Check for Typos:Double-check the spelling of names, addresses, and other personal details before finalizing the paystub. A small mistake can lead to complications when applying for loans, mortgages, or even filing taxes.

- Ensure Accuracy:If using an auto-filled template, verify that all data matches the information in your records (e.g., employment contracts or official documents).

- Update Details Regularly:Ensure that any changes to personal details (e.g., change of address, marital status) are reflected in the paystub.

2. Incorrect Pay Period

Problem:

Another frequent error is the misalignment of the pay period. Sometimes, paystubs are generated with the wrong dates, leading to confusion about the actual work period being paid for.

How to Fix It:

- Verify the Pay Period:Ensure the pay period (e.g., weekly, bi-weekly, monthly) matches your payroll schedule. If you are generating the paystub manually, carefully input the correct start and end dates for each pay period.

- Review the Paystub Period vs. Payment Date:Sometimes, people confuse the payment date with the pay period. The payment date is when the funds are disbursed, whereas the pay period is the time during which the work was done.

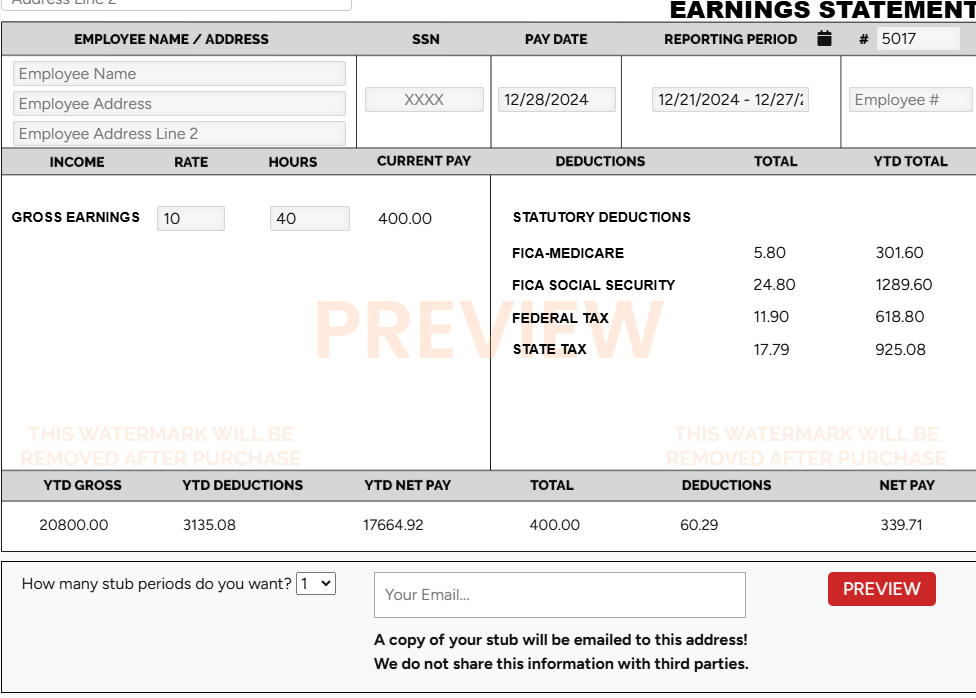

3. Incorrect Gross Earnings

Problem:

Gross earnings errors can occur due to input mistakes or misunderstandings about overtime, bonuses, or commissions. Incorrect gross earnings can result in overpayment or underpayment, affecting both the employee and employer.

How to Fix It:

- Double-Check Hours Worked:If hourly, ensure the number of hours worked is accurate, including overtime or holiday pay. For salaried employees, confirm the correct salary is entered.

- Include Bonuses and Commissions:Ensure any additional earnings such as performance bonuses, sales commissions, or tips are properly included in the total gross earnings.

- Use Correct Multipliers:If you’re calculating overtime, remember to apply the correct overtime multiplier (usually 1.5x for hours worked beyond 40 in a week, depending on local laws).

4. Errors in Deductions (Tax or Benefit Contributions)

Problem:

Deductions, such as taxes, insurance, retirement contributions, and other benefits, are sometimes calculated incorrectly on free paystub generators. This can be due to outdated tax rates, incorrect deduction types, or missing deductions altogether.

How to Fix It:

- Verify Tax Rates and Rules:Check that the applicable federal, state, and local tax rates are up-to-date. If using a free paystub generator, ensure that it uses current tax rates based on the year and the employee’s state of residence.

- Confirm Benefits Contributions:Ensure deductions for benefits like health insurance, retirement plans (401(k), pensions), and other perks are properly listed. Compare the paystub with your records or with the HR department to ensure all deductions are correct.

- Use Payroll Software for Accuracy:Consider using a payroll software or platform that’s regularly updated with the latest tax laws and deduction rules. This minimizes the risk of errors.

5. Incorrect Net Pay (Take-Home Pay)

Problem:

Net pay is the amount an employee takes home after all deductions have been made. An error in calculating the net pay can occur if any of the deductions are calculated wrong or if the gross earnings aren’t accurate.

How to Fix It:

- Manually Check Calculations:Subtract the total deductions from the gross earnings to ensure that the net pay is accurate. The formula is:

Net Pay = Gross Earnings – Deductions. - Verify Deductions:Review each line of deductions carefully (taxes, insurance, retirement contributions, etc.) to ensure they are correct. Sometimes, errors happen when multiple deductions are stacked or entered incorrectly.

- Cross-Check With Bank Statements:After receiving payment, compare the actual deposit amount with the net pay listed on the paystub. If they don’t match, further investigation may be needed.

6. Missing Employer Information

Problem:

Another common mistake in free paystub templates is leaving out the employer’s details, such as the company name, address, and tax identification number (TIN). Missing employer details can lead to confusion, especially when paystubs are used for loan applications or tax filing.

How to Fix It:

- Enter Employer Details:Ensure that the employer’s name, address, and TIN (or Employer Identification Number, EIN) are entered correctly. These details should be present on all paystubs.

- Cross-Reference with Official Documents:Double-check the employer information with official company records to ensure accuracy. Some paystub generators will auto-fill this information based on previous entries, but it’s always best to verify it manually.

7. Errors in Overtime and Hourly Rates

Problem:

If an employee works overtime or receives a special hourly rate, it’s essential that these numbers are accurately reflected in the paystub. Common errors include failing to calculate overtime correctly or listing the wrong hourly rate.

How to Fix It:

- Accurate Hourly Rate:Make sure that the standard hourly rate and overtime rate (if applicable) are correct. In most jurisdictions, overtime should be calculated at 1.5 times the regular hourly rate after 40 hours in a week.

- Cross-Check Overtime Hours:Ensure that overtime hours are clearly separated and calculated separately from regular hours.

8. Lack of Proper Formatting

Problem:

While this issue may not affect the legality of the paystub, a poorly formatted paystub can create confusion or make it harder to verify information. A disorganized layout could lead to overlooked errors.

How to Fix It:

- Use Professional Templates:Free paystub generators may offer basic templates. Ensure the template you choose is well-organized, with clear sections for gross earnings, deductions, and net pay. Each category should be clearly labeled.

- Ensure Consistent Formatting:Align the figures neatly and ensure that the currency format is consistent throughout the document.

Conclusion

Free paystub generators are a convenient tool for creating paystubs, but they can be prone to errors if not carefully reviewed. Common errors include inaccurate personal information, incorrect pay periods, and miscalculations of earnings and deductions. By carefully reviewing the generated paystub, cross-referencing with your records, and ensuring that all information is accurate, you can avoid these issues.

Taking the time to fix these errors will ensure that your paystub is legally compliant, accurate, and free from discrepancies, protecting both the employee and employer from potential complications. Always double-check each section and, when in doubt, consult with a payroll professional to ensure complete accuracy.